Trade Facilities

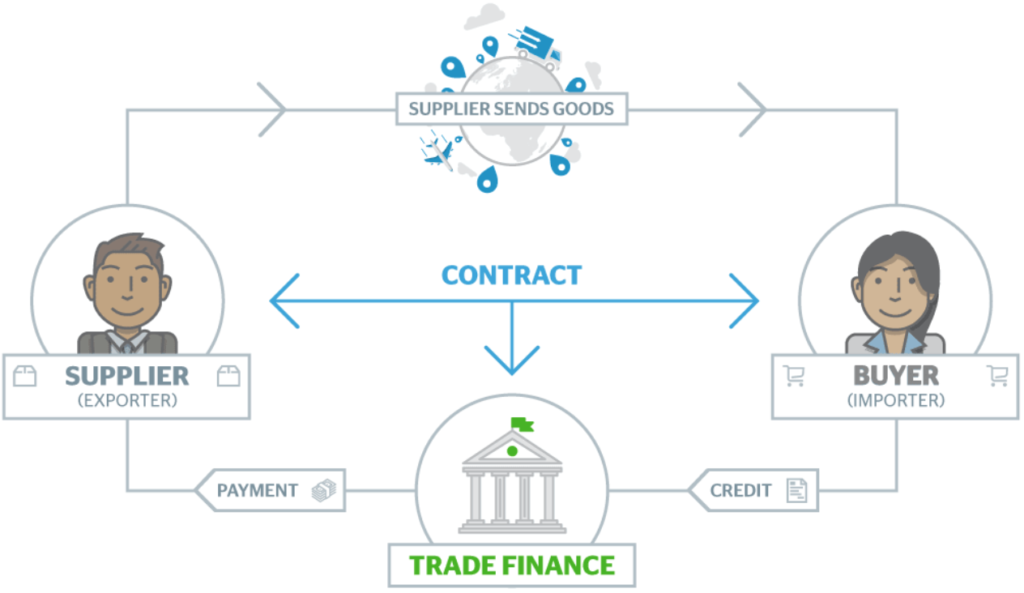

Trade facilities are products used by companies to facilitate international trade and commerce. It allows easier cashflow for importers and exporters to transact business through trade. While helping to reduce the risk associated with global trade by reconciling the divergent needs of an exporter(s) and importer(s).

Products: Invoice Financing, Factoring, Pre-shipment, PO Financing

- Up to S$1 billion per company

- Processing time 2-4 weeks

- Interest rates from 2% per year

- Discount charge annual renewal

Trade Facilities

Trust Receipt/Invoice Financing

Bankers Guarantee

A Banker’s Guarantee (BG) is a definite undertaking by the bank (guarantor) to pay the beneficiary a certain sum of money within a specified period if the applicant (principal) fails to fulfill his contractual or other obligations of an underlying transaction. It is normally used to secure either a financial or performance obligation of the principal.

Factoring

Private Financing

In the event that you require more financing or no financial institution willing to take additional risk, we have our own private lender to customise a solution for your business. Thus, in One Suite Advisory, we have an array of solutions for you.

Contact One Suite Advisory, our best sme loan broker will help you to get small business loan, start-up business loan, sme business loans and funding in Singapore.